INSURANCE STRATEGIES

Do You Have The Right Insurance. Do You Have Enough Coverage?

Life insurance

Life Insurance is not only about what you leave behind when you pass away. Most new policies include living benefits that help you to thrive while you are alive!

Some myths and misunderstandings are:

Life insurance is too expensive

I’m single, so I don’t need it

I don’t have kids, so I don’t need it

I’m too old or have pre-existing health conditions, so I will never get approved

I get life insurance through my employee benefits, so I don’t need anymore

Only my beneficiaries will reap the reward

Too many people go without life insurance because they do not understand all its potential benefits.

As an experienced and licensed insurance professional, I can customize the right insurance coverage for you and your family based on your financial situation and goals. You not only want to have the right amount of coverage but the right kind.

Are you ready to see how implementing life insurance can enhance your financial picture? Do you already have life insurance and want a professional to review it? Connect with one of our Financial Professionals.

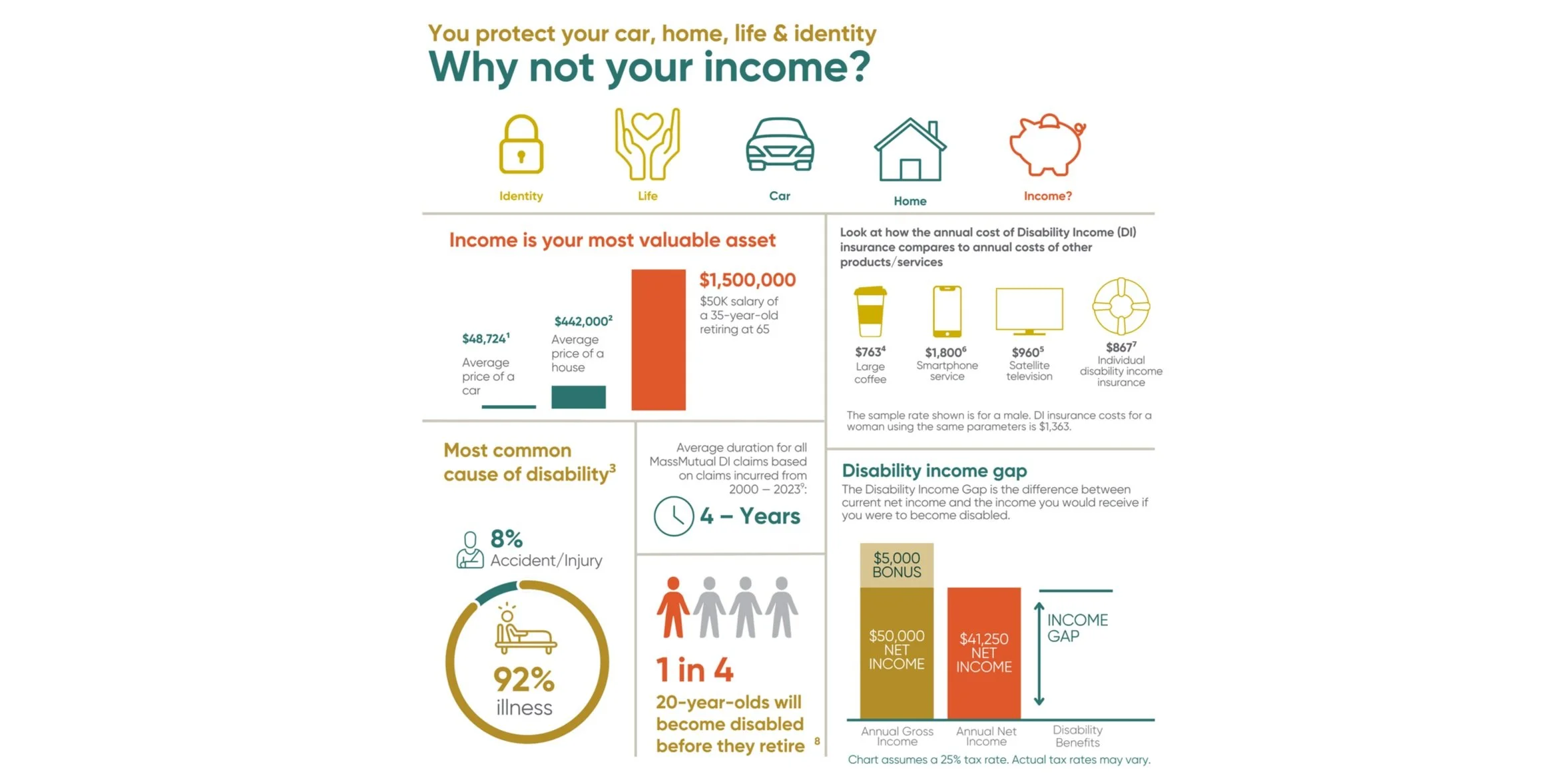

income protection

One of the foundational pieces to the success of any wealth strategy is uninterrupted cash flow.

If you get sick or hurt for an extended period of time and cannot work, how will your household or business cash flow be impacted? How will you pay your mortgage, car note, children’s schooling, medical bills, and even your business payroll if your paycheck stops because you can’t work? This coverage is also known as long-term disability income insurance.

Kelley Blue Book, November 2024.

Redfin.com, July 2024.

MassMutual approved DI Claims 2000-2023.

Source: Fastfoodmenuprices.com October 2023. Daily large coffee at Dunkin’ Donuts — $2.09 per day.

Source: DirecTV.com January 2025. Choice package with DirecTV — $79.99 per month.

Source: T Mobile January 2025. Go5G Plus Plan — $150.00 per month.

Male age 30, Radius Choice 4A occ class, 90 day waiting period, benefit period to age 65, $4,050 monthly total disability benefit. Annual premium for a Female client with the same assumptions: $1,363.

U.S. Social Security Administration, Fact Sheet 2024.

Data is for all disability income insurance policies issued by Massachusetts Mutual Life Insurance Company (MassMutual®).

How long would your savings last if you couldn’t earn a paycheck?

annuities

Are you over 50 years old and you want to ensure you have a guaranteed income each year to cover your basic living expenses (or more) after you stop working? Annuities can be a great way to achieve this but you need to understand:

What type of annuity is right for you?

What type of annuity should you avoid?

What is the cost/benefit of the annuity(ies) you are considering?

How much should you put into an annuity?

Are you taxed on the income from the annuity? If yes, how much?

Do you want/need the income right away or years down the road?

Let one of our Financial Professionals help you answer these questions and recommend an annuity strategy that will help you reach your overall financial goals.